“Pink Tax” in the United States

March 8, 2022

Have you ever wondered why Dove soaps, Venus razors, and other hygienic products are more expensive for women? The answer to that question lies in the hypothetical “pink tax” enforced by import tariffs in the United States. Researchers of gender inequality have discovered this discrepancy in products ranging from toys for children to feminine products for adults. This issue began gaining prominence after the careful examination of 794 products by the New York City’s Consumer Affairs, which found multiple cases of “gendering” in prices. After studies were conducted, it was established that this was a worldwide phenomenon. However, today, America is ultimately working to transform the everyday inequalities and divide between men and women [1].

In 1996, Californian Governor Pete Wilson required merchants to charge women and men the same price if the manufacturing took the same time, effort and skill to produce though this act merely targeted services and not physical products. Then, in 1998, the former New York Mayor Rudy Giuliani signed a bill that restricted hairdressers from basing prices on gender. Another crucial example was the Pink Tax Repeal Act that was proposed various times in California but regrettably never passed [1].

At a fundamental level, the tax is a primary result of import tariffs. A study conducted by the Texas A&M University’s Mosbacher University, which focuses on commerce and trade, concluded that clothing companies pay higher amounts of money on silk shirts, wool jackets, cotton suits, suit jackets etc. A 2020 study published in the journal American Political Science Review discovered that women’s goods are taxed 0.7% more than men’s. Additionally, the lack of representation for women in the legislature is a potential cause. The pink tax is imposed on wholesalers and retailers and women, who pay an approximate $1,351 per person for those products and services, feel the full burden of the tax [1].”

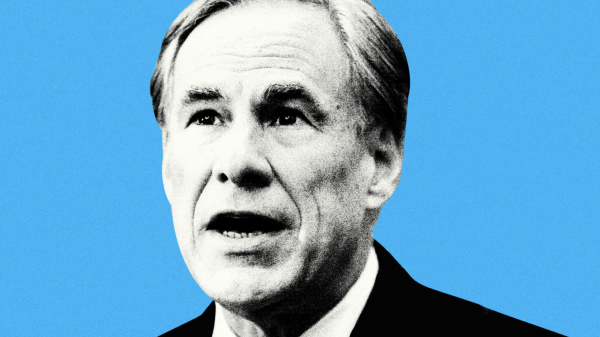

Nonetheless, following these discoveries, people are working to determine the best solutions to not only eliminate the pink tax but additionally, to raise awareness of the discrepancies that continue to exist in society. As a matter of fact, the National Defense Authorization Act of 2022 was signed into effect on December 27th, 2021, which placed emphasis on ending the “pink tax” on military uniforms. It required the Department of Defense to create and regulate criteria which designate certain attire as military to keep out-of-pocket costs equivalent for both genders. Furthermore, the passage of this act was a clear example of women in the legislature finally voicing their opinions for equality, as this section of the act was proposed by New Hampshire’s Senator Maggie Hassan [2]. What’s more, starting from July of 2022, women in Louisiana will get a tax break valued at 11 million dollars as prices for feminine and hygienic products are set to drop. Governor John Bel Edwards signed the bill that initiated the “pink tax” exemption by eliminating the 4.45% sales tax on the said products. Florida is the only other state that has implemented this bill in law to date [3]. Lastly, a beneficial bill named the “Pink Tax Repeal Act” has been introduced to Congress and it promotes the prohibition of varying prices for vastly similar products solely based on the gender it is marketed towards [4].

The strong aspect of equality on all counts will be achieved through the elimination of the pink tax in America’s future. As citizens of not just the country but also students of Ridge, let us educate. Let us inform. And let us strive to transform the dream of an entirely equal society into reality. It starts with us.

[1]https://www.investopedia.com/pink-tax-5095458#toc-unequal-tariffs-on-womens-goods-the-real-pink-tax

[4]https://www.govtrack.us/congress/bills/117/hr3853

Yuying Wang '23 • Mar 28, 2022 at 12:06 pm

What a well-written article!!! I actually know a few people who looked into the “pink tax” for their AP Research project, so it was definitely nice to read more about it here!!! Nice job!

Sumedha Maddali • Apr 27, 2022 at 5:11 pm

Thank you! That’s so interesting because I got inspiration to write this article from my AP Seminar class. This topic is quite eye-opening. 🙂